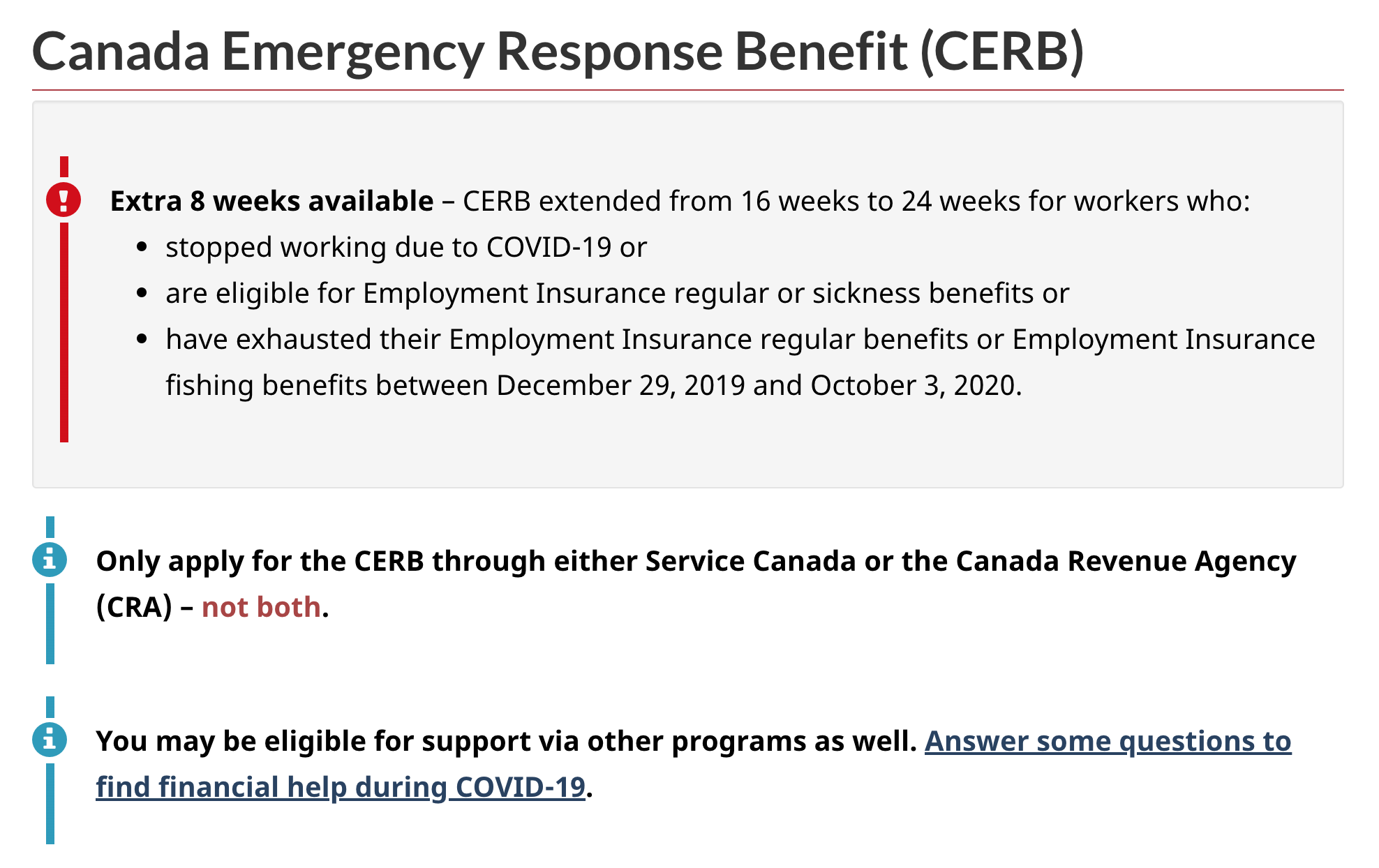

A screenshot from the Government of Canada website captured on July 8, 2020. Alerts remind site visitors that the CERB has been extended from 16 to 24 weeks; that applications to the CERB can be made via the CRA or Service Canada (but not both); and that anyone eligible for the CERB may be eligible for support via other programs as well.

[Last updated: July 8, 2020] It has been three months since the government introduced the CERB payments, and although we were all hopeful that businesses would be back to ‘normal’ by now, that has proved to be far from the truth. As some businesses begin to reopen, many artists are still waiting to see their sources of income come back.

CERB Extension (and one change)

CERB has been extended another eight weeks to August 29 (a change from a 16-week eligibility period to 24). Most of the same requirements apply as with the previous periods, with one notable addition. Recipients must now sign an attestation stating that they are actively looking for work. This is an ordinary requirement for people collecting unemployment insurance, and since CERB is acting as a parallel for unemployment insurance, this additional requirement makes sense.

Eligibility

As a reminder, CERB is available to those who:

Are over the age of 15 and living in Canada

Have stopped working because of COVID (either because they were sick, taking care of a sick person, or taking care of children who can’t get daycare)

Earned at least $5,000 in the last 12 months (before self-employment deductions)

Have NOT quit their job voluntarily

Have NOT earned more than $1,000 in the period in which they are claiming the benefit

The CRA has not released any information on how they will be confirming recipients’ eligibilities. At the moment, it is up to the individual to attest to their own eligibility.

Timing of Earnings

One question that has come up often with respect to self-employed artists is the timing of that $1,000 earnings restriction. We have heard from many people who are nervous about depositing a cheque into their bank account because they are worried it will alert the CRA that they have earned that income at that time. However, the revenue restriction is based on the timing of when you earned it, not when you physically received the money. If you worked on a project in January and the client has just paid you now, that payment does not count towards the $1,000 earned income for the period in which you’re depositing that money into your bank account. It was earned back in January, not today. Keep in mind, the reverse is also true: if you’re doing work on a paid project now, you’re technically earning that money now – even if you don’t get paid for it until October.

The same would apply for royalty payments. If the royalties are earned for work you did during the application period, that would count towards the $1,000 minimum, but not if the royalties were for work you completed in a prior period.

The CERB government website is actually quite helpful and lists a number of scenarios to help you understand when and if you qualify for the benefit.

Note

[July 20, 2020] We’ve been hearing that folks are getting conflicting information about time of earnings v. time of payment, so we want to clarify how we arrived at the above conclusion. Under the accrual basis of accounting, revenues are reported on the income statement when they are earned. When the revenues are earned but cash is not received, the asset will be recorded as accounts receivable. In contrast, under the cash basis of accounting, revenues are not reported on the income statement until the cash is received. (Source: AccountingCoach.com)

CRA is making no distinction between accrual or cash accounting - but generally accepted accounting principals use the accrual method. One valuable reference point here is the question and answer below, via the government CERB website:

“Do artists’ royalties count as employment or self-employment income with respect to the CERB?

”Yes, in some cases. Artists’ royalties would be considered payments received as self-employment income if they were received as compensation for using or allowing the use of a copyright, patent, trademark, formula or secret process that is a result of their own work or invention. These royalties count towards the $5,000 income threshold, as well as towards the $1,000 that claimants can earn per month while receiving the Benefit. However, royalty payments received from work that took place before the period for which a person applies for the Canada Emergency Response Benefit do not count as income during that specific benefit period. Other royalties (i.e., from investment activities) do not count with respect to the Benefit.”

Retroactive Applications

Keep in mind that applications to CERB can be made retroactively, up until December 2, 2020. So if you didn’t apply because you didn’t think you qualified, but when you reviewed the eligibility requirements you in fact were eligible – you can apply at any time before December 2.

More Resources

Rags to Reasonable’s Chris Enns shared ‘9 Thoughts on Financial Planning in the Time of Covid.’

This is the third post in our blog series on Artist Finances in the Time of Covid. If you’re looking for more context, check out The Economics of Covid-19 for Arts Workers and Tracking Financial Losses due to Covid-19, both of which were last updated on March 30, 2020.

If you are in crisis, here are some resources on ArtistProducerResource.com: Mental Health, Health Care, Housing and Childcare, COVID-19 Artist Health & Safety