Please note this post has not been updated since March 30, 2020 and should not be referred to for the most up-to-date information.

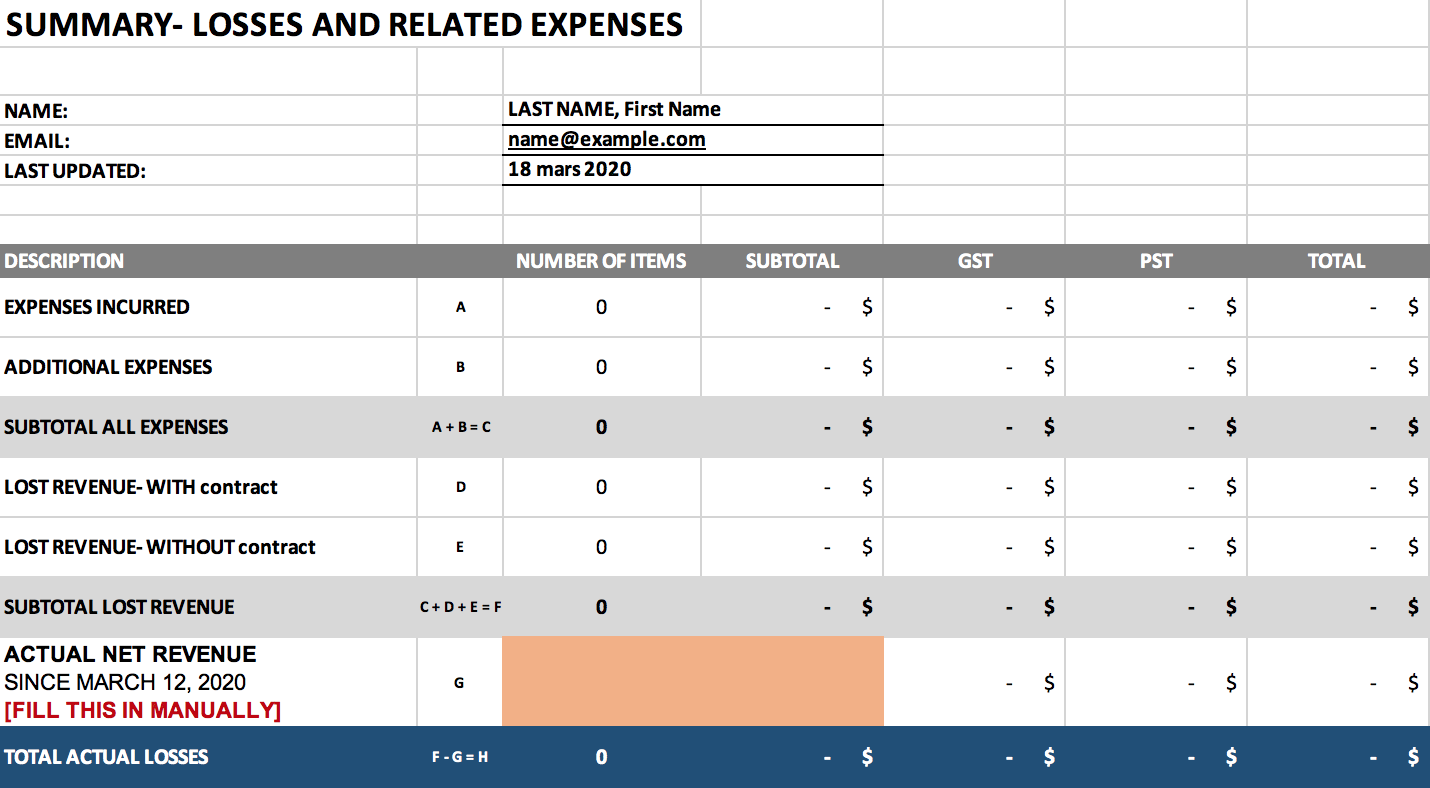

A screenshot from Arts Link New Brunswick’s Lost Income Tracking Tool.

What are your losses?

Those who work in the arts have been hugely impacted by physical distancing measures taken in response to the COVID-19 pandemic. While our governments and arts councils are still in the process of determining what financial support they will be able to provide to workers who have been affected by event cancellations and public closures, they have all stated the importance of documenting your financial losses. An important part of this is collecting all contracts and cancellation notices (that email you got notifying you that your show was not going on? Save it as a PDF).

Here’s what to keep in mind…

If you were producing an event that has been canceled or postponed, your financial losses would include:

Artist and production fees paid for the event that didn’t happen/hasn’t happened

Hours you have volunteered outside of the scope of your contract, likely due to making the decision to cancel/postpone and communicate it, as well as the time that goes into tracking your losses

Advertising (print or online) for the event and anything with dates on it that is no longer relevant, or that may become irrelevant should details change as a result of postponement (e.g. venue change, cast change)

Non-refundable deposits/payments for venue rental, equipment rental, etc.

Insurance

If you are postponing your event, it might be the right time to consider “remounting” costs, such as:

Additional Artist and production fees

Additional Producer fees

Advertising and rental costs

Rehearsal and Venue rental

Insurance

Potentially diminished box office revenues (given that future measures to ensure public health and safety may include lowered seating capacities and/or lower attendance)

It is very likely that these losses will need to be proven/documented, so make sure your invoices are well organized. If you didn’t have contracts, now’s the time to make them. If you are producing your own show, make an estimate of the time you already spent working on it, and will have to spend working on it in the future, and set a rate for yourself.

If you are wanting to track losses for work outside of the arts, such as in the service industry, it might be worth tracking the following things:

Hours worked each week for the past six months and, if relevant, tips earned - this will help estimate your losses related to the cancellation/closure

Any emails or notifications from your producer/employer of event cancellation/business closure

Services, health care, or self-care expenses that you continued to pay while you were experiencing income loss and didn’t have the resources to cover the costs

Expenses that you incurred because you were expecting to work but did not, such as costumes/materials purchased, travel expenses

Tools

ArtsLink New Brunswick has created a Lost Income Tracker. Visit their website to download the Excel template in English or French.

Tau S. Bui and Pam Tzeng have created French and English versions (respectively) of a similar tracking tool, which gives you the option to select your province and input tax information relevant to you. Excel en français ici, Google Sheet in English here.

Other things to keep in mind…

File your taxes

Perhaps the most important thing is to make sure your taxes are up to date. Even if you are behind a couple of years, take the time now to file. Loss calculations are often based on past earnings. If you need support with your taxes, the Income Tax page on ArtistProducerResource.com is a good place to start.

On March 18, the Federal Government announced that the individual filing due date for 2020 will be deferred to June 1, 2020. Read more here.

Fill out surveys about your losses

Arts organizations with mandates to advocate for the arts sector have been and will continue to collect data about losses to the arts sector and artists. These surveys help these organizations advocate to government on behalf of the whole sector. Please take a moment to share your information and experience with them.

Canada: PACT Survey

Ontario: TAPA Survey

BC: GVPTA Survey (includes a budgeting framework)

Statements from funders about COVID-19

Canada Council (updated March 16, 2020)

Ontario Arts Council (updated March 16, 2020)

Toronto Arts Council (updated March 16, 2020)

Government Support

In general, Employment Insurance is a program is for folks who are employed and have had their employment disrupted through no fault of their own.

Here is a resource for applying for EI from BC that outlines how to apply:

For those out of work due to self-quarantine. Do not have to be laid off by your employer to qualify, but must be able to say your employer or a medical professional asked that you stay home. You must be unable to work from home to qualify.

For those out of work due to workplace closure due to COVID-19. Must have worked a combined total of 700 hours in the last year if you worked in Vancouver. This is all your workplaces combined.

For those on quarantine that may finish their quarantine to find their workplace closed.

On March 18, the federal government announced a COVID-19 emergency response package:

For Canadians without paid sick leave (or similar workplace accommodation) who are sick, quarantined or forced to stay home to care for children, the Government is:

Waiving the one-week waiting period for those individuals in imposed quarantine that claim Employment Insurance (EI) sickness benefits. This temporary measure will be in effect as of March 15, 2020.

Waiving the requirement to provide a medical certificate to access EI sickness benefits.

Introducing the Emergency Care Benefit providing up to $900 bi-weekly, for up to 15 weeks. This flat-payment Benefit would be administered through the Canada Revenue Agency (CRA) and provide income support to:

Workers, including the self-employed, who are quarantined or sick with COVID-19 but do not qualify for EI sickness benefits.

Workers, including the self-employed, who are taking care of a family member who is sick with COVID-19, such as an elderly parent, but do not quality for EI sickness benefits.

Parents with children who require care or supervision due to school closures, and are unable to earn employment income, irrespective of whether they qualify for EI or not.

It might be worth considering Self-Employment Insurance, however it is worth noting that even if you applied now, you would not be eligible for benefits until 12 months after registration.

Further Resources

If you’re in BC, here’s a handy guide for applying to E.I.

If you are in financial crisis, here are some resources on ArtistProducerResource.com: